Welcome to our informative blog post, where we will delve into the intriguing topic of how much money it takes to start a business. Starting a business is an exciting and potentially lucrative venture, but one of the most crucial aspects that aspiring entrepreneurs must consider is the initial investment required. Whether you have a groundbreaking idea or are simply curious about the financial side of entrepreneurial endeavors, this article aims to provide you with a comprehensive guide on determining the right amount of capital to kickstart your business.

Contents

- 1 1. Understanding the Importance of Financial Planning

- 2 2. Evaluating Your Startup Costs

- 3 3. Assessing Available Financing Options

- 4 4. Creating a Business Budget

- 4.1 The Importance of a Business Budget

- 4.2 Identifying Income Sources

- 4.3 Tracking Fixed and Variable Expenses

- 4.4 Estimating Monthly and Annual Costs

- 4.5 Accounting for One-Time and Recurring Costs

- 4.6 Setting Priorities and Allocating Funds

- 4.7 Monitoring and Adjusting Your Budget

- 4.8 Seeking Professional Advice

- 5 5. Managing Cash Flow Effectively

- 5.1 The Importance of Cash Flow Management

- 5.2 Monitoring Cash Inflows

- 5.3 Tracking Cash Outflows

- 5.4 Forecasting and Projecting Future Cash Flow

- 5.5 Implementing Invoicing and Payment Strategies

- 5.6 Negotiating Favorable Payment Terms with Suppliers

- 5.7 Building a Cash Reserve

- 5.8 Regular Cash Flow Analysis and Reporting

- 5.9 Utilizing Cash Flow Management Tools

- 6 6. Contingency Planning for Unforeseen Expenses

- 6.1 The Importance of Contingency Planning

- 6.2 Assessing Potential Risks and Expenses

- 6.3 Creating a Contingency Fund

- 6.4 Continuously Reviewing and Updating Your Contingency Plan

- 6.5 Working with Insurance Providers

- 6.6 Building Relationships with Suppliers and Service Providers

- 6.7 Documenting Contingency Procedures

- 6.8 Reviewing Legal and Regulatory Requirements

- 6.9 Training and Preparing Your Team

- 7 7. Scaling Your Business: Investment for Growth

- 7.1 The Importance of Scaling for Business Growth

- 7.2 Analyzing Growth Opportunities

- 7.3 Evaluating Financial Readiness

- 7.4 Developing a Scalable Business Model

- 7.5 Investing in Human Resources

- 7.6 Expanding Marketing Efforts

- 7.7 Upgrading Infrastructure and Technology

- 7.8 Monitoring and Adjusting Financial Projections

- 7.9 Managing Risks and Contingencies

- 8 8. Seeking Professional Financial Advice

- 8.1 The Role of Financial Professionals

- 8.2 Assessing Your Financial Needs

- 8.3 Choosing the Right Financial Professional

- 8.4 Consulting with an Accountant

- 8.5 Engaging a Financial Advisor

- 8.6 Working with a Business Consultant

- 8.7 Collaborating with Legal Professionals

- 8.8 Regular Communication and Collaboration

- 8.9 Continued Learning and Self-Education

- 9 9. Maximizing ROI: Investing Wisely

- 9.1 The Importance of Strategic Investments

- 9.2 Conducting Market Research

- 9.3 Assessing Return on Investment (ROI)

- 9.4 Identifying Growth Opportunities

- 9.5 Analyzing Competitors

- 9.6 Considering Cost-Effective Solutions

- 9.7 Seeking Expert Advice

- 9.8 Monitoring and Evaluating Investments

- 9.9 Balancing Risk and Reward

- 10 10. Continuous Monitoring and Adaptation

- 10.1 The Importance of Continuous Monitoring

- 10.2 Tracking Key Financial Indicators

- 10.3 Reviewing and Updating Your Budget

- 10.4 Analyzing Cash Flow Patterns

- 10.5 Identifying Cost-saving Opportunities

- 10.6 Monitoring Market Trends and Competition

- 10.7 Seeking Feedback and Input

- 10.8 Staying Informed about Regulatory Changes

- 10.9 Embracing Flexibility and Adaptation

1. Understanding the Importance of Financial Planning

Embarking on a business venture requires careful financial planning to set a solid foundation for success. Without a well-thought-out financial plan, you may find yourself facing unexpected hurdles that could jeopardize your business’s stability. Financial planning involves assessing your business idea, estimating costs, and ensuring you have the necessary funds to support your operations.

The Role of Financial Planning in Business

Financial planning is like a roadmap for your business, guiding you towards your goals and helping you navigate potential obstacles. It allows you to make informed decisions about your financial resources, both present and future, ensuring that your business stays on track.

- Building Resilient Strategies: Ensuring Just-in-Time Manufacturing with Robust Supply Chains

- Exploring Lucrative Business Opportunities in Canada: A Comprehensive Guide

- Exploring Lucrative Business Ideas: Unveiling Untapped Opportunities for Aspiring Entrepreneurs

- Jumpstart Your Entrepreneurial Journey: A Comprehensive Guide to Launching a Successful Small Business

- The Ultimate Guide: 10 Easiest Business Ideas to Kickstart Your Entrepreneurial Journey

Assessing Your Business Idea

Before diving into the financial aspects, it is crucial to thoroughly evaluate your business idea. Consider factors such as market demand, competition, and potential profitability. Understanding the viability of your business idea will help you estimate realistic financial goals and determine the level of investment required.

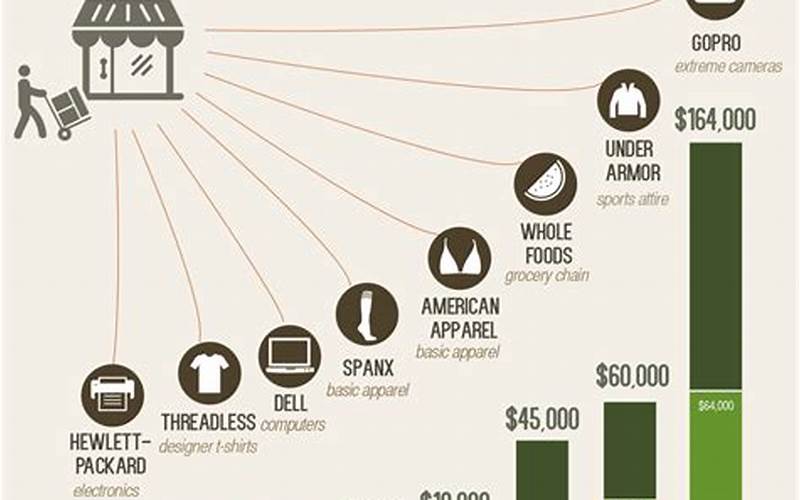

Estimating Start-Up Costs

One of the key aspects of financial planning is estimating the start-up costs involved in launching your business. These costs can include equipment, technology, office space, licenses, permits, marketing, and initial inventory. Thoroughly research each expense to ensure you have an accurate estimate of the funds needed to get your business up and running.

Forecasting Future Expenses

Financial planning is not limited to just the initial start-up costs. It also involves forecasting future expenses that your business will incur. This includes ongoing operational costs such as rent, utilities, salaries, marketing, and inventory replenishment. By forecasting these expenses, you can better understand the financial demands your business will face in the long run.

Identifying Potential Risks

Financial planning also involves assessing potential risks that could impact your business’s financial stability. Consider factors such as economic downturns, changes in market trends, and unexpected events that could affect your revenue streams or increase your expenses. By identifying these risks, you can develop strategies to mitigate their impact and ensure your business remains resilient.

Creating Realistic Financial Goals

Financial planning helps you set realistic goals for your business. By analyzing your market potential, projecting revenue streams, and considering your expenses, you can create financial targets that align with your business objectives. These goals will serve as benchmarks to track your progress and make informed decisions along the way.

Attracting Investors and Securing Financing

An effective financial plan can also help attract potential investors or secure financing from banks or other lenders. When seeking external funding, having a well-documented financial plan demonstrates your commitment to responsible financial management and enhances your credibility.

Overall, understanding the importance of financial planning is crucial for any aspiring entrepreneur. It serves as a strategic tool to guide your business towards success, allowing you to make informed decisions, mitigate risks, and ensure the long-term viability of your venture.

2. Evaluating Your Startup Costs

Before launching your business, it’s crucial to evaluate and estimate the startup costs involved. Understanding these costs will help you determine the financial resources you’ll need to kickstart your venture. By conducting thorough research and analysis, you can ensure that you have a realistic grasp of the financial investment required.

Identifying Essential Expenses

Start by identifying the essential expenses your business will incur during its initial stages. These expenses can include equipment, office space, furniture, technology, licenses, permits, legal fees, branding, and initial inventory. By listing each expense, you can create a comprehensive overview of your startup costs.

Researching Market Rates

Researching market rates is vital to accurately estimate your startup costs. Look for industry benchmarks and gather quotes from suppliers, contractors, and service providers to determine the average costs associated with each expense. This research will help you avoid overestimating or underestimating your expenses.

Accounting for One-time and Recurring Costs

Startup costs can be categorized as one-time or recurring expenses. One-time costs are incurred at the beginning of your business journey, such as purchasing equipment or renovating your workspace. Recurring costs, on the other hand, are ongoing expenses that you’ll need to consider, such as rent, utilities, salaries, and marketing expenses. Including both types of costs in your evaluation will give you a clear picture of your financial commitments.

Considering Variable and Fixed Costs

It’s important to distinguish between variable and fixed costs when evaluating your startup expenses. Variable costs fluctuate with the level of production or sales, such as raw materials or packaging. Fixed costs, on the other hand, remain constant regardless of your business’s performance, such as rent or insurance premiums. Understanding these cost differentiations will help you plan your finances more effectively.

Estimating Realistic Figures

While estimating your startup costs, it’s essential to be as realistic as possible. Avoid overly optimistic projections or underestimating expenses, as this can lead to financial challenges down the line. Consider any unforeseen or hidden costs that may arise and include a buffer in your estimates to account for these unexpected expenditures.

Reviewing and Refining Your Estimates

As your research and planning progress, periodically review and refine your estimated startup costs. This will ensure that your financial projections remain accurate and up-to-date. Be open to adjusting your figures based on new information, market trends, or changes in your business model.

Documenting Your Startup Costs

It’s crucial to document and keep track of your startup costs for future reference. Use spreadsheets or accounting software to record each expense, along with supporting documents such as invoices and receipts. This documentation will not only help you monitor your financial progress but also serve as valuable information when seeking financing or tax deductions.

Evaluating your startup costs is a fundamental step in starting a business. By carefully assessing and estimating your expenses, you can create a solid financial foundation and ensure that your business has the necessary resources to thrive.

3. Assessing Available Financing Options

Once you have a clear understanding of your startup costs, it’s time to explore the various financing options available to fund your business. Assessing these options will help you determine the most suitable and viable sources of capital to bring your entrepreneurial dreams to life.

Personal Savings

Using personal savings is a common financing option for many entrepreneurs. It allows you to invest your own money into your business, giving you full control and ownership. Assess your personal financial situation and evaluate how much you can comfortably allocate towards your business without jeopardizing your personal financial stability.

Loans from Friends and Family

Another potential financing option is borrowing money from friends and family. This can be an accessible and flexible option, as the terms and conditions can be more lenient compared to traditional lenders. However, it’s important to approach these arrangements with professionalism and clarity to avoid any strain on personal relationships.

Bank Loans

Bank loans are a common financing option for small businesses. Approach local banks or credit unions and inquire about business loans that suit your needs. Be prepared to present a comprehensive business plan, financial projections, and collateral if required. Compare different loan options and carefully review the terms and interest rates to make an informed decision.

Crowdfunding

Crowdfunding platforms have gained popularity as a means of raising capital for businesses. Through online platforms, you can present your business idea and offer individuals the opportunity to contribute financially. In return, backers may receive rewards or equity in your company. Research crowdfunding platforms and understand their terms and conditions before launching a campaign.

Angel Investors

Angel investors are individuals or groups who provide capital to startups in exchange for equity or convertible debt. These investors often have industry experience and can provide valuable guidance along with funding. Seek out angel investor networks, attend pitch events, or leverage online platforms to connect with potential investors who align with your business vision.

Small Business Grants

Government organizations, nonprofits, and private foundations offer small business grants to support entrepreneurs. Research grant opportunities specific to your industry, location, or demographic to increase your chances of securing funding. Keep in mind that grant applications often require detailed proposals and may have specific eligibility criteria.

Business Incubators and Accelerators

Business incubators and accelerators are organizations that provide support, mentorship, and sometimes financing to startups. They often have specific programs designed to nurture and accelerate the growth of young businesses. Research local or industry-specific incubators and accelerators that may be interested in funding your business.

Partnerships and Joint Ventures

Forming partnerships or joint ventures with other businesses can be a mutually beneficial financing option. By pooling resources and sharing risks, you can access additional capital and expertise. Assess potential partners who complement your business and negotiate agreements that align with your goals and expectations.

Self-Financing through Revenue Generation

Depending on the nature of your business, you may be able to finance your venture through revenue generation. This approach involves using the profits generated by your business to fund its growth and expansion. While this may require a longer timeline, it allows you to maintain full ownership and control over your business.

Consider the pros and cons of each financing option and determine which ones are best suited for your business. It’s often wise to explore multiple sources of funding to mitigate risks and ensure a robust financial foundation for your entrepreneurial journey.

4. Creating a Business Budget

A well-structured business budget is a crucial tool for managing your finances effectively and ensuring the long-term success of your venture. By creating a comprehensive budget, you can track your expenses, allocate resources efficiently, and make informed financial decisions.

The Importance of a Business Budget

A business budget serves as a roadmap for your financial activities. It allows you to set clear financial goals, monitor your cash flow, and make adjustments when necessary. By having a budget in place, you can avoid overspending, identify areas for cost savings, and ensure that you have enough funds to cover your business’s needs.

Identifying Income Sources

Start by identifying all potential sources of income for your business. This includes revenue generated from sales, services, partnerships, or any other income streams specific to your industry. By understanding your income sources, you can better estimate your cash inflow and plan your budget accordingly.

Tracking Fixed and Variable Expenses

Divide your expenses into fixed and variable categories. Fixed expenses are recurring costs that remain relatively constant, such as rent, utilities, insurance premiums, and salaries. Variable expenses, on the other hand, fluctuate based on factors like production levels or sales volume, such as raw materials or marketing expenses. Categorizing expenses will help you allocate funds more effectively.

Estimating Monthly and Annual Costs

Estimate your monthly and annual costs based on historical data, market research, or projections. Be as accurate as possible to ensure that you have a realistic picture of your financial commitments. Consider any seasonal fluctuations or one-time expenses that may occur throughout the year.

Accounting for One-Time and Recurring Costs

Include both one-time and recurring costs in your budget. One-time costs may include equipment purchases, renovations, or marketing campaigns. Recurring costs are ongoing and repeat periodically, such as monthly subscriptions or annual licensing fees. By accounting for both types of expenses, you can effectively manage your financial resources.

Setting Priorities and Allocating Funds

Set priorities within your budget to determine where your funds should be allocated. This may involve allocating more resources to areas that directly contribute to revenue generation or strategic growth. By aligning your budget with your business objectives, you can allocate funds efficiently and ensure that your financial resources are utilized effectively.

Monitoring and Adjusting Your Budget

A business budget should not be a static document. Regularly monitor your actual expenses and compare them to your budgeted amounts. Identify any deviations and make necessary adjustments. This flexibility allows you to adapt to changing circumstances and make informed decisions to keep your business financially healthy.

Seeking Professional Advice

If you’re unsure about creating a budget or need assistance, consider seeking advice from financial professionals, such as accountants or financial advisors. They can provide valuable insights, help you set realistic financial goals, and guide you through the budgeting process.

A well-crafted business budget is an essential tool for financial management. By creating a comprehensive budget and regularly reviewing it, you can ensure that your business remains financially stable and on track to achieve its goals.

5. Managing Cash Flow Effectively

Managing cash flow is a critical aspect of running a successful business. It involves monitoring the inflow and outflow of cash to ensure that your business has enough funds to cover its expenses and remain operational. By implementing effective cash flow management strategies, you can maintain a healthy financial position and avoid potential cash flow challenges.

The Importance of Cash Flow Management

Effective cash flow management is essential for the financial stability and growth of your business. It allows you to meet your financial obligations, pay your bills on time, and have a clear understanding of your business’s financial health. By managing your cash flow effectively, you can make informed decisions, seize opportunities, and navigate through potential cash flow fluctuations.

Monitoring Cash Inflows

Start by monitoring your cash inflows, which include sales revenue, customer payments, and any additional income sources. Regularly track and analyze the timing and amount of cash coming into your business. This will help you understand your cash flow patterns and anticipate any potential gaps or surpluses.

Tracking Cash Outflows

Equally important is tracking your cash outflows, which include expenses such as rent, utilities, payroll, inventory, marketing, and loan repayments. Keep a record of all your expenses and categorize them to gain insights into your spending patterns. This enables you to identify areas where you can potentially reduce costs and optimize your cash flow.

Forecasting and Projecting Future Cash Flow

Forecasting and projecting your future cash flow is crucial for effective cash flow management. Analyze historical data, market trends, and sales projections to estimate your future cash inflows and outflows. By understanding your expected cash flow, you can plan ahead, make strategic decisions, and ensure you have enough cash on hand to cover upcoming expenses.

Implementing Invoicing and Payment Strategies

Implementing efficient invoicing and payment strategies can significantly impact your cash flow. Invoice promptly and clearly communicate your payment terms to clients or customers. Consider offering incentives for early payments or implementing a system to track and chase overdue payments. These strategies can help you improve your cash inflow and reduce the risk of late or non-payments.

Negotiating Favorable Payment Terms with Suppliers

Negotiating favorable payment terms with suppliers can also contribute to effective cash flow management. Try to negotiate extended payment terms or discounts for early payments. This can help you manage your cash outflows more efficiently by aligning your payment obligations with the timing of your cash inflows.

Building a Cash Reserve

Building a cash reserve is a prudent strategy to handle unexpected expenses or cash flow gaps. Set aside a portion of your cash inflows as a reserve fund. This reserve can act as a safety net during challenging times or serve as a source of capital for future business opportunities.

Regular Cash Flow Analysis and Reporting

Regularly analyze and report on your cash flow to stay informed about your business’s financial position. Generate cash flow statements that outline your cash inflows, outflows, and ending cash balances. These statements provide a comprehensive overview of your cash flow and help you identify any areas that require attention or improvement.

Utilizing Cash Flow Management Tools

Consider utilizing cash flow management tools or software to streamline and automate your cash flow processes. These tools can help you track your cash flow, generate reports, and provide insights into your financial performance. Choose a tool that suits the specific needs of your business and empowers you to make data-driven decisions.

Effective cash flow management is essential for the financial stability and growth of your business. By implementing these strategies and staying vigilant about your cash flow, you can ensure that your business remains financially healthy and well-positioned for success.

6. Contingency Planning for Unforeseen Expenses

Even with meticulous financial planning, unforeseen expenses can arise during your entrepreneurial journey. It is crucial to set aside a contingency fund to handle these unexpected costs and ensure that your business remains resilient in the face of uncertainty. By incorporating contingency planning into your financial strategy, you can mitigate the impact of unforeseen expenses and maintain stability.

The Importance of Contingency Planning

Contingency planning is essential because unexpected expenses can arise at any time and disrupt your business operations. By preparing for these unforeseen events, you can reduce the financial stress they may cause and ensure that your business can continue to function without major disruptions.

Assessing Potential Risks and Expenses

Start by assessing potential risks and expenses that your business may encounter. Consider factors such as equipment breakdowns, legal disputes, natural disasters, fluctuations in market conditions, or unexpected changes in regulations. By identifying these risks, you can estimate the potential impact on your finances and develop strategies to mitigate them.

Creating a Contingency Fund

Establish a contingency fund specifically designated to cover unforeseen expenses. Set aside a portion of your revenue or allocate a percentage of your monthly budget towards this fund. Aim to accumulate a sufficient amount that can provide a safety net to handle unexpected costs without jeopardizing your day-to-day operations.

Continuously Reviewing and Updating Your Contingency Plan

Regularly review and update your contingency plan to ensure its effectiveness. As your business evolves and circumstances change, reassess potential risks and adjust your contingency fund accordingly. Stay informed about industry trends, technological advancements, or any external factors that may impact your business, and update your plan accordingly.

Working with Insurance Providers

Consider working with insurance providers to protect your business against specific risks. Business insurance policies can provide coverage for events like property damage, liability claims, or business interruption. Consult with insurance professionals to determine the types of coverage that align with your business needs and budget.

Building Relationships with Suppliers and Service Providers

Building strong relationships with your suppliers and service providers can be valuable during unforeseen events. Establish open and honest communication channels, and discuss potential contingency plans with them. This can help you negotiate flexible payment terms, access additional resources, or receive support during challenging times.

Documenting Contingency Procedures

Documenting your contingency procedures is crucial for smooth execution when unexpected events occur. Clearly outline the steps to be taken and the individuals responsible for implementing the contingency plan. This documentation will ensure that everyone involved is aware of their roles and can act swiftly if a contingency situation arises.

Reviewing Legal and Regulatory Requirements

Unforeseen expenses can sometimes arise due to legal or regulatory changes. Stay informed about relevant laws and regulations that affect your business and review them periodically. This will help you anticipate any potential compliance-related expenses and adapt your contingency plan accordingly.

Training and Preparing Your Team

Involve your team in the contingency planning process to ensure everyone is prepared to handle unexpected situations. Provide training on relevant procedures, roles, and responsibilities. By equipping your team with the knowledge and skills to respond effectively, you can minimize the impact of unforeseen events on your business.

Contingency planning is a proactive approach to safeguarding your business against unforeseen expenses. By taking the time to assess potential risks, establish a contingency fund, and develop strategies, you can ensure that your business remains resilient and adaptable, even in the face of unexpected challenges.

7. Scaling Your Business: Investment for Growth

As your business starts to gain traction and grow, you may consider scaling your operations to meet increasing demand. Scaling requires additional investment in areas such as hiring more staff, expanding your marketing efforts, or upgrading your infrastructure. It is important to carefully assess the financial implications of scaling and determine the optimal timing and approach to ensure sustainable growth.

The Importance of Scaling for Business Growth

Scaling allows your business to accommodate increased demand, expand its reach, and capitalize on new opportunities. It enables you to meet customer needs more efficiently, improve your competitive position, and potentially increase profitability. However, scaling should be approached strategically and supported by adequate financial resources.

Analyzing Growth Opportunities

Before investing in scaling your business, analyze growth opportunities in your market or industry. Conduct market research, identify emerging trends, and assess customer demand. Understanding the potential for growth will help you make informed decisions about where to allocate your financial resources for maximum impact.

Evaluating Financial Readiness

Assess your business’s financial readiness for scaling. Evaluate your cash flow, profitability, and access to additional capital. Scaling will require upfront investment, so it’s important to ensure that your financial position can support the expansion without jeopardizing your day-to-day operations or long-term stability.

Developing a Scalable Business Model

To support scaling, develop a scalable business model that can accommodate growth while maintaining efficiency. This may involve streamlining processes, implementing automation, or leveraging technology to increase productivity. A scalable business model ensures that your operations can handle increased demand without compromising quality or incurring excessive costs.

Investing in Human Resources

Scaling often requires expanding your workforce. Assess your staffing needs and invest in hiring and training additional employees to handle increased workload and maintain service quality. Consider the cost of recruitment, onboarding, and ongoing payroll expenses when budgeting for scaling.

Expanding Marketing Efforts

To support your business’s growth, allocate resources to expand your marketing efforts. This may involve increasing your advertising budget, implementing targeted campaigns, or exploring new marketing channels. Effective marketing is crucial for attracting new customers, increasing brand awareness, and driving sales during the scaling process.

Upgrading Infrastructure and Technology

Scaling may require upgrading your infrastructure or technology to support increased capacity or operational efficiency. Assess your current systems and determine if any upgrades or investments are necessary. This can include investing in new equipment, software solutions, or IT infrastructure to better serve your growing customer base.

Monitoring and Adjusting Financial Projections

Regularly monitor and adjust your financial projections as you scale your business. Track key performance indicators (KPIs), analyze financial data, and compare actual results against your projections. This will help you identify areas that require attention, make informed decisions, and ensure that your scaling efforts align with your financial goals.

Managing Risks and Contingencies

Scaling your business inherently involves risks. Evaluate potential risks associated with scaling, such as increased competition, operational challenges, or market fluctuations. Develop contingency plans to address potential setbacks and ensure that you have the financial resources to navigate unforeseen circumstances during the scaling process.

Scaling your business requires strategic planning and financial investment. By carefully analyzing growth opportunities, evaluating financial readiness, and implementing scalable business practices, you can position your business for sustainable growth and success in the long term.

8. Seeking Professional Financial Advice

Navigating the financial aspects of starting and running a business can be complex and overwhelming, especially if you lack expertise in finance. Seeking professional financial advice can provide you with valuable insights, guidance, and support throughout your entrepreneurial journey. By consulting with financial professionals, you can gain a deeper understanding of your financial situation, make informed decisions, and ensure compliance with tax regulations.

The Role of Financial Professionals

Financial professionals, such as accountants, financial advisors, or business consultants, have the knowledge and experience to guide you through various financial aspects of your business. They can provide expert advice on financial planning, budgeting, tax strategies, and investment decisions. Their expertise can help you optimize your financial resources and minimize financial risks.

Assessing Your Financial Needs

Before seeking professional financial advice, assess your specific financial needs. Determine which areas of your business you require assistance with, such as bookkeeping, tax planning, or financial forecasting. This will help you identify the type of financial professional who can best address your needs.

Choosing the Right Financial Professional

Research and evaluate potential financial professionals to find the one who best fits your business requirements. Consider factors such as their expertise, qualifications, industry experience, and reputation. Seek recommendations from trusted sources or professional networks to ensure you select a reliable and trustworthy advisor.

Consulting with an Accountant

An accountant can assist you with various financial aspects of your business. They can help you set up accounting systems, manage financial records, and ensure compliance with tax regulations. Accountants can also provide insights on financial reporting, cash flow management, and tax planning, helping you make informed financial decisions.

Engaging a Financial Advisor

A financial advisor can provide holistic advice on managing your business’s finances. They can help you develop comprehensive financial plans, assess investment opportunities, and create strategies for long-term financial growth. A financial advisor can also provide guidance on retirement planning, risk management, and estate planning.

Working with a Business Consultant

A business consultant can offer specialized expertise in various areas of your business’s financial management. They can assist with market research, financial analysis, and strategic planning. Business consultants can help you identify growth opportunities, optimize your operations, and improve profitability through their industry insights and knowledge.

Collaborating with Legal Professionals

Legal professionals can also play a role in your business’s financial matters. They can provide guidance on legal structures, contracts, intellectual property rights, and regulatory compliance. Collaborating with legal professionals ensures that your financial decisions align with legal requirements and mitigates the risk of legal disputes.

Regular Communication and Collaboration

Establish regular communication and collaboration with your chosen financial professionals. Keep them informed about your business’s financial status, goals, and challenges. This ongoing partnership allows them to provide tailored advice and support that aligns with your evolving financial needs.

Continued Learning and Self-Education

While seeking professional financial advice is valuable, it is also important to continue learning and educating yourself about financial management. Stay updated on financial trends, tax regulations, and industry-specific financial practices. This knowledge will enable you to actively participate in financial discussions and make well-informed decisions for your business.

Seeking professional financial advice is an investment in the long-term financial health of your business. By partnering with financial professionals who understand your unique needs, you can gain confidence in your financial decision-making and position your business for success.

9. Maximizing ROI: Investing Wisely

Investing your startup capital wisely is crucial for the long-term success and growth of your business. Making informed investment decisions can help you maximize your return on investment (ROI) and allocate your resources effectively. By conducting thorough market research, analyzing competitors, and identifying growth opportunities, you can make strategic investments that propel your business forward.

The Importance of Strategic Investments

Strategic investments contribute to the overall success and profitability of your business. By allocating your resources wisely, you can optimize your business’s growth potential, improve operational efficiency, and gain a competitive edge in the market. Strategic investments also help you mitigate risks and capitalize on emerging trends or market opportunities.

Conducting Market Research

Prior to making any investment decisions, conduct comprehensive market research. Understand your target market, customer preferences, and industry trends. Analyze the demand for your product or service, study your competition, and identify any gaps or opportunities in the market. This research provides valuable insights for making informed investment choices.

Assessing Return on Investment (ROI)

When evaluating potential investments, assess the expected return on investment (ROI). Calculate the potential financial gains or benefits that an investment can generate compared to its cost. Consider both the short-term and long-term impacts of the investment on your business’s profitability and growth.

Identifying Growth Opportunities

Identify growth opportunities that align with your business goals and values. This may include expanding into new markets, introducing new products or services, or investing in innovative technologies. Assess the potential risks and rewards of each opportunity and prioritize those that offer the highest potential for long-term growth and profitability.

Analyzing Competitors

Study your competitors and analyze their strategies and investments. Identify areas where your competitors are excelling or falling short. This analysis can provide insights into potential investment opportunities or areas where you can differentiate your business. By understanding your competitors’ strengths and weaknesses, you can make strategic investments that give you a competitive advantage.

Considering Cost-Effective Solutions

When making investment decisions, consider cost-effective solutions that offer high value for your business. Evaluate different vendors, suppliers, or service providers to ensure you are getting the best quality at the most competitive price. Look for opportunities to streamline processes, optimize resources, or leverage technology to maximize efficiency while minimizing costs.

Seeking Expert Advice

Seeking expert advice from industry professionals or consultants can provide valuable insights when making investment decisions. Engage with professionals who have experience in your industry and understand the nuances of your business. Their expertise can help you evaluate investment opportunities, identify potential risks, and make informed decisions that align with your business strategy.

Monitoring and Evaluating Investments

Continuously monitor and evaluate the performance of your investments. Track key performance indicators (KPIs) and compare them against your initial expectations. Regularly review the ROI of your investments and make adjustments if necessary. This ongoing evaluation ensures that your investments continue to contribute to your business’s growth and profitability.

Balancing Risk and Reward

Investments inherently carry risks, but it’s essential to balance risk and reward. Diversify your investments to spread risks across different areas or asset classes. Consider the potential impact of an investment on your business’s financial stability and growth potential. By carefully assessing risks and rewards, you can make strategic investments that align with your risk tolerance and business objectives.

Maximizing your ROI through wise investments is a key driver of business success. By conducting thorough research, assessing opportunities, seeking expert advice, and continuously evaluating your investments, you can make informed decisions that drive growth, enhance profitability, and position your business for long-term success.

10. Continuous Monitoring and Adaptation

Financial planning is not a one-time activity but rather an ongoing process. It is essential to regularly monitor your financial performance, review your budget, and adapt your strategies as needed. By staying vigilant and proactive, you can make data-driven decisions that optimize your business’s financial health and ensure long-term sustainability.

The Importance of Continuous Monitoring

Continuous monitoring allows you to stay informed about your business’s financial performance and make timely adjustments. It helps you identify trends, spot potential issues, and seize opportunities. By monitoring key financial indicators, you can proactively address challenges, optimize cash flow, and make informed decisions about resource allocation.

Tracking Key Financial Indicators

Determine the key financial indicators that are relevant to your business and track them regularly. This may include metrics such as revenue, gross profit margin, cash flow, inventory turnover, or customer acquisition cost. Monitoring these indicators provides a snapshot of your business’s financial health and helps you identify areas that require attention.

Reviewing and Updating Your Budget

Regularly review and update your budget based on your actual financial performance and changing business circumstances. Compare your budgeted amounts with your actual income and expenses to identify any variances. Adjust your budget as needed to ensure it remains aligned with your business goals and reflects the current financial reality.

Analyzing Cash Flow Patterns

Closely analyze your cash flow patterns to ensure healthy cash flow management. Identify any recurring cash flow gaps or surpluses and develop strategies to address them. This may involve adjusting payment terms with suppliers, negotiating contracts, or implementing measures to accelerate customer payments. Analyzing cash flow patterns helps you maintain a steady and sustainable financial position.

Identifying Cost-saving Opportunities

Regularly seek opportunities to reduce costs and increase efficiency. Analyze your expenses, identify areas where you can cut unnecessary expenditures, and negotiate better deals with suppliers. Look for ways to streamline processes, optimize resources, or leverage technology to improve productivity and reduce expenses without compromising quality.

Monitoring Market Trends and Competition

Stay informed about market trends and changes in your industry. Monitor the activities of your competitors to identify potential threats or opportunities. Understanding market dynamics allows you to adapt your financial strategies and make informed decisions about pricing, marketing, and resource allocation.

Seeking Feedback and Input

Seek input and feedback from stakeholders, such as employees, customers, and financial advisors. Their perspectives can provide valuable insights and help you identify areas for improvement. Encourage open communication and create a culture that values collaboration and continuous improvement.

Staying Informed about Regulatory Changes

Keep yourself updated on regulatory changes that may affect your business’s financial operations. Stay informed about tax laws, compliance requirements, and industry-specific regulations. Compliance with regulations helps you avoid penalties and ensures the long-term financial stability and reputation of your business.

Embracing Flexibility and Adaptation

Flexibility and adaptability are essential qualities for financial success. Be prepared to adjust your strategies as circumstances change. Continuously evaluate your financial performance, market conditions, and business goals to determine if adjustments are necessary. Embrace innovation and be open to exploring new opportunities that align with your financial objectives.

Continuous monitoring and adaptation are key to maintaining a strong financial position in an ever-changing business landscape. By staying proactive, responsive, and open to change, you can optimize your financial performance, seize opportunities, and ensure the long-term success of your business.

In conclusion, starting and running a business involves careful financial planning, monitoring, and adaptation. Understanding the initial investment required and evaluating available financing options are crucial steps in setting a strong financial foundation. Creating a business budget helps allocate resources effectively and manage cash flow, while contingency planning prepares for unforeseen expenses.

As your business grows, scaling requires strategic investments to maximize ROI and support expansion. Seeking professional financial advice can provide valuable insights and ensure compliance with regulations. Continuous monitoring and adaptation enable you to make informed decisions, optimize financial performance, and navigate challenges.

By implementing these practices and staying proactive in managing your business’s finances, you can position yourself for long-term success. Remember, financial success is not a one-time achievement but an ongoing process that requires vigilance, flexibility, and a commitment to financial health.