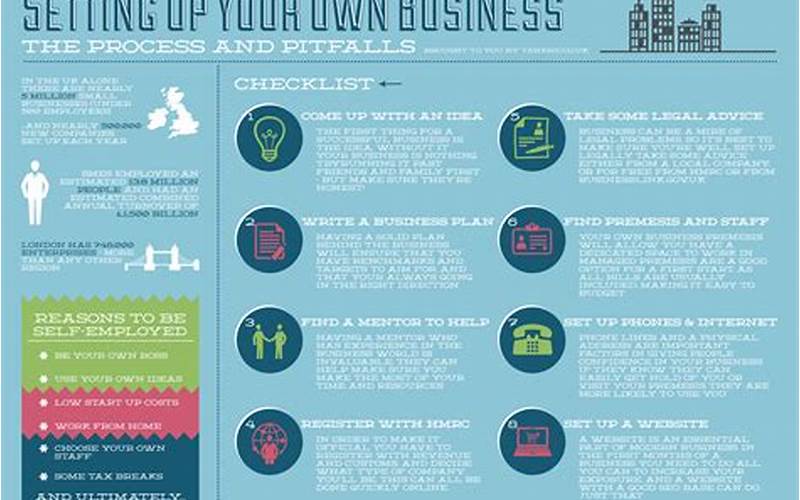

Welcome to our comprehensive guide on how to set up a business in the UK. Whether you’re an aspiring entrepreneur or an established company looking to expand across borders, understanding the process of establishing a business in the UK is crucial. In this article, we’ll walk you through each step, providing you with valuable insights and practical tips to ensure a smooth setup. From legal requirements and registration procedures to tax considerations and available support, we’ve got you covered. So, let’s dive in and explore the exciting world of business setup in the UK!

Contents

- 1 Understanding the UK Business Landscape

- 2 Legal Requirements and Business Structures

- 3 Registering Your Business in the UK

- 4 Tax Obligations and Considerations

- 5 Funding Options for Your UK Business

- 6 Finding the Ideal Business Location

- 7 Hiring Employees and Employment Regulations

- 8 Intellectual Property Protection

- 9 Marketing and Promoting Your UK Business

- 10 Support and Resources for UK Businesses

Understanding the UK Business Landscape

Before embarking on your journey to set up a business in the UK, it’s crucial to gain a comprehensive understanding of the business landscape in the country. The UK boasts a diverse and thriving economy, with various industries offering exciting opportunities for entrepreneurs.

The Industry Spectrum: From finance and technology to manufacturing and creative industries, the UK offers a wide range of sectors to explore. Researching and understanding the current trends, market demands, and growth potential in your chosen industry is key to making informed business decisions.

- The Ultimate Guide to Effortless Business Beginnings: Unveiling the Simplest Start-Up Ventures and How to Succeed

- The Evolving Landscape of Workplace Automation: Adapting Job Roles and Acquiring New Skills

- Demystifying Business Start-up Costs: A Comprehensive Guide to Launching Your Venture

- Top 10 Profitable Small Business Ideas to Kickstart in 2023

- Mastering Competitive Market Pricing: Unleashing the Power of Value-Based and Dynamic Strategies

Consumer Behavior and Market Trends: Analyzing consumer behavior and market trends is vital in identifying gaps in the market and potential target audiences. Keep an eye on evolving consumer preferences, emerging technologies, and market disruptors that may shape the landscape of your industry.

Competitor Analysis: Conducting a thorough analysis of your competitors can provide valuable insights into their strategies, positioning, and unique selling points. This analysis will help you differentiate your business and identify opportunities to offer innovative products or services.

Regional Considerations: The UK is composed of various regions, each with its own unique advantages and characteristics. Consider factors such as infrastructure, transport links, proximity to suppliers or customers, and the availability of skilled labor when choosing your business location.

Government Initiatives and Incentives: The UK government actively supports businesses through various initiatives, grants, and tax incentives. Familiarize yourself with programs available for startups, research and development, export support, and other schemes that can provide financial assistance and boost your business growth.

Networking and Industry Associations: Building a strong network within your industry is invaluable. Joining industry-specific associations, attending networking events, and connecting with like-minded professionals can open doors to collaboration, mentorship, and potential partnerships.

By immersing yourself in the UK business landscape and staying informed about industry dynamics, you’ll be equipped with the knowledge necessary to make informed decisions and capitalize on the numerous opportunities available.

Legal Requirements and Business Structures

When setting up a business in the UK, it’s crucial to understand the legal requirements and choose the appropriate business structure that aligns with your goals and ensures compliance with the law.

Legal Requirements:

Before diving into the specifics of business structures, familiarize yourself with the general legal requirements. These may include registering your business, obtaining necessary permits or licenses, understanding health and safety regulations, and adhering to employment laws.

Business Structures:

The UK offers several business structures, each with its own advantages and considerations. Here are some common options:

Sole Proprietorship: As a sole proprietor, you are the sole owner of the business and personally liable for its debts. This structure is relatively simple to set up, but keep in mind that your personal assets are at risk in case of business liabilities.

Partnership: A partnership involves two or more individuals who share ownership and responsibilities. It’s important to establish a partnership agreement that outlines the roles, profit-sharing, and dispute resolution mechanisms.

Limited Liability Partnership (LLP): An LLP combines elements of a partnership and a limited company. It offers limited liability for the partners and flexibility in terms of taxation and profit distribution.

Limited Company: A limited company is a separate legal entity from its owners, offering the advantage of limited liability. It can be a private limited company (Ltd) or a public limited company (PLC) if seeking to trade shares publicly.

Social Enterprise Structures: If your business has a social or environmental mission, you may consider structures such as Community Interest Companies (CICs) or Charitable Incorporated Organizations (CIOs) that allow you to combine profit-making with social impact.

Professional Services Structures: Certain professions, such as lawyers, accountants, and architects, have specific structures like Limited Liability Partnerships (LLPs) tailored to their needs.

Each business structure has its own implications for ownership, liability, taxation, and reporting requirements. It’s crucial to consult with legal and financial professionals to determine the most suitable structure for your specific business.

Registering Your Business in the UK

Registering your business is a crucial step in establishing its legal identity and ensuring compliance with UK regulations. The registration process varies depending on the type of business structure you choose. Here’s a breakdown of the steps involved:

Sole Proprietorship and Partnership:

If you’re operating as a sole proprietor or in a partnership, you have the option to trade under your own name or choose a business name. Registering a business name is not mandatory, but it can help protect your brand identity. You’ll need to inform HM Revenue and Customs (HMRC) about your self-employment or partnership status and register for self-assessment for tax purposes.

Limited Company:

Registering a limited company involves several steps:

- Choose a Name: Select a unique company name that complies with Companies House guidelines. Ensure that the name is not already in use and meets the requirements set by Companies House.

- Submit Documents: Prepare the necessary documents, including Articles of Association, Memorandum of Association, and Form IN01, which contains information about the company’s directors, shareholders, and registered address.

- Register with Companies House: Submit the required documents and pay the registration fee to Companies House either online or by mail. Once approved, you’ll receive a Certificate of Incorporation, confirming your company’s legal existence.

- Register for Taxes: Register your company for Corporation Tax with HMRC. You may also need to register for other taxes such as VAT (if applicable) and Pay As You Earn (PAYE) if you plan to hire employees.

Note that there may be additional requirements depending on the nature of your business, such as obtaining specific licenses or permits. Consulting with professionals or using online registration services can help streamline the process and ensure accuracy.

Remember to maintain accurate records of your business activities, financial transactions, and any changes to your company’s details. Filing annual accounts and tax returns with Companies House and HMRC is essential to meet your legal obligations as a registered business in the UK.

Tax Obligations and Considerations

Understanding the tax obligations and considerations for your business is essential to ensure compliance with HM Revenue and Customs (HMRC) and manage your finances effectively. Here are some key aspects to consider:

Corporate Taxes:

As a business operating in the UK, you’ll be subject to corporate taxes. The current rate of corporation tax is X%, but it’s important to stay updated as rates can change over time. Familiarize yourself with the tax rules, allowable deductions, and deadlines for filing tax returns.

VAT (Value Added Tax):

Depending on your business activities and turnover, you may need to register for VAT. VAT is a consumption tax applied to most goods and services in the UK. Understanding the different VAT schemes, such as standard rate, reduced rate, or flat rate, will help you determine the most suitable option for your business.

Employer Obligations:

If you hire employees, you’ll have additional tax obligations as an employer. This includes deducting income tax and National Insurance contributions from employee wages, reporting payroll information to HMRC through Real-Time Information (RTI), and providing year-end documents like P60s and P11Ds.

Self-Assessment:

If you’re a sole proprietor or in a partnership, you’ll need to complete a self-assessment tax return. This involves reporting your business income, expenses, and any other relevant sources of income. Ensure you understand the self-assessment process and meet the deadlines for submission and payment.

Tax Planning and Accounting:

Effective tax planning can help minimize your tax liability and optimize your financial position. Consider consulting with a tax advisor or accountant who can provide guidance on tax-efficient strategies, allowable deductions, and help you stay compliant with tax regulations.

It’s crucial to maintain accurate financial records, including sales, expenses, and payroll information. Using accounting software or hiring professional bookkeeping services can simplify the process and ensure your financial records are organized and up to date.

Remember to stay informed about any changes to tax laws and regulations that may affect your business. Keeping up with your tax obligations will not only help you avoid penalties but also contribute to the long-term financial success of your business.

Funding Options for Your UK Business

Securing adequate funding is often a crucial aspect of setting up or expanding a business in the UK. Here are some funding options you can explore:

Business Loans:

Traditional bank loans are a common funding option for businesses. Research different banks and financial institutions to find loan options that suit your needs. Prepare a solid business plan and financial projections to increase your chances of approval.

Government Grants and Support:

The UK government offers various grants and support programs to help businesses across different sectors. Research government initiatives such as Innovate UK, the British Business Bank, or regional development agencies that provide funding opportunities and support services.

Crowdfunding:

Crowdfunding platforms allow businesses to raise funds from a large pool of individuals who contribute small amounts. Create a compelling campaign, showcasing your business idea and the potential benefits to attract backers.

Venture Capital (VC) and Angel Investors:

VC firms and angel investors provide funding to high-growth businesses in exchange for equity. Seek out investors who specialize in your industry and have a track record of successful investments. Prepare a strong pitch deck and be ready to negotiate terms.

Business Incubators and Accelerators:

Joining a business incubator or accelerator program can provide not only funding but also valuable mentorship, guidance, and access to networks. Research and apply to programs that align with your business goals and offer the support you need.

Self-Funding and Bootstrapping:

Using personal savings or revenue generated by your business to fund your operations is a common approach. While it may require discipline and careful financial management, self-funding allows you to maintain control and ownership of your business.

Alternative Financing Options:

Explore alternative funding options such as peer-to-peer lending, revenue-based financing, or business credit cards. Each option has its own advantages and considerations, so assess them carefully before making a decision.

Remember, securing funding often involves presenting a compelling business case and demonstrating your ability to generate returns. Prepare a solid financial plan, conduct thorough research, and be proactive in seeking the right funding opportunities for your UK business.

Finding the Ideal Business Location

Choosing the right location for your business in the UK is a crucial decision that can impact your success. Consider the following factors when evaluating potential business locations:

Infrastructure and Accessibility:

Assess the infrastructure available in the area, including transportation links, road networks, and access to ports or airports. Consider how easily customers, suppliers, and employees can reach your location.

Proximity to Target Markets:

Consider the proximity of your business to your target markets. Being close to your customers can reduce transportation costs, improve customer service, and provide opportunities for networking and collaboration.

Availability of Skilled Workforce:

Research the availability of skilled labor in the area. Consider factors such as universities, colleges, and vocational training centers that can provide a pool of qualified candidates for your business needs.

Cost of Living and Business Expenses:

Evaluate the cost of living and business expenses in the area. Assess factors such as property prices, rental costs, utilities, and taxes. Balancing costs with other favorable factors is important for the long-term sustainability of your business.

Business Support and Networks:

Explore the availability of business support services and networks in the area. Look for business organizations, chambers of commerce, and networking events that can provide valuable resources, mentorship, and opportunities for collaboration.

Competitive Landscape:

Analyze the competitive landscape in the area. Research existing businesses in your industry and assess the demand and saturation levels. Consider how you can differentiate your business and identify potential gaps or opportunities.

Quality of Life:

Consider the overall quality of life in the area, including factors such as healthcare, education, cultural amenities, and recreational opportunities. A location that offers a high quality of life can attract and retain talent.

Take the time to visit potential locations, talk to local business owners, and consult with professionals who can provide insights into specific areas. By carefully evaluating these factors, you can find the ideal business location that aligns with your goals and sets your business up for success in the UK.

Hiring Employees and Employment Regulations

Expanding your team is a significant milestone for any business. When hiring employees in the UK, it’s essential to navigate the employment regulations and ensure compliance with the law. Here’s what you need to know:

Hiring Process:

Start by defining your hiring needs and creating detailed job descriptions. Advertise your vacancies through various channels, such as online job boards, recruitment agencies, or professional networks. Ensure your hiring process is fair, transparent, and complies with anti-discrimination laws.

Employment Contracts:

Provide written employment contracts to your employees, outlining essential terms and conditions such as job responsibilities, working hours, pay, and holiday entitlement. Familiarize yourself with different types of contracts, such as permanent, fixed-term, or zero-hours contracts, and ensure they meet legal requirements.

Minimum Wage Laws:

Ensure you pay your employees at least the National Minimum Wage or National Living Wage, depending on their age and employment status. Stay updated with any changes in minimum wage rates and adjust employee salaries accordingly.

Worker’s Rights and Benefits:

Understand and respect worker’s rights, including provisions for rest breaks, annual leave, maternity and paternity leave, and sick pay. Familiarize yourself with employee benefits such as pensions, health insurance, and workplace schemes.

Health and Safety:

Provide a safe and healthy working environment for your employees. Conduct risk assessments, provide necessary training, and comply with health and safety regulations. Display relevant safety information and ensure employees have access to first aid facilities.

Tax and National Insurance Contributions (NICs):

Register as an employer with HM Revenue and Customs (HMRC) and deduct income tax and National Insurance contributions from your employees’ wages. Report payroll information to HMRC through Real-Time Information (RTI) and ensure you meet the deadlines for submission and payment.

Termination and Redundancy:

Understand the procedures and legal requirements for terminating employment contracts or making employees redundant. Follow fair and transparent processes, provide notice periods or redundancy pay when applicable, and consult with legal professionals if necessary.

Staying informed about employment regulations and seeking professional advice when needed will help you build a compliant and motivated workforce. Prioritize good communication, fair treatment, and ongoing employee development to create a positive working environment and drive the success of your UK business.

Intellectual Property Protection

Protecting your intellectual property (IP) is crucial for safeguarding your business’s unique ideas, inventions, and brand identity. Understanding the basics of intellectual property rights in the UK is essential. Here are the key areas to consider:

Trademarks:

Registering a trademark helps protect your brand name, logo, or slogan from being used by others. Conduct a thorough search to ensure your desired trademark is not already registered. Once registered, you can use the ® symbol, signaling your exclusive rights to the mark.

Copyrights:

Copyright automatically protects original creative works, such as literature, music, art, and software. While registration is not required in the UK, it’s advisable to keep records of your creations and use the © symbol to assert your copyright ownership.

Patents:

If you have invented a new product, process, or technology, you may consider applying for a patent. Patents grant exclusive rights and prevent others from making, using, or selling your invention without permission. Consult with a patent attorney to determine if your invention meets the necessary criteria for patentability.

Design Rights:

Design rights protect the appearance of your products or designs. In the UK, you can obtain automatic unregistered design rights or register your designs to gain additional protection. Registering your designs provides stronger rights and makes it easier to enforce them.

Trade Secrets and Confidentiality:

Trade secrets are valuable business information that gives you a competitive advantage. Implement measures to keep confidential information secure, such as non-disclosure agreements (NDAs) with employees and business partners.

IP Infringement:

Monitor your industry for any potential infringement of your IP rights. If you discover any unauthorized use of your trademarks, copyrights, or patents, take appropriate legal action to protect your rights and seek compensation if necessary.

Consider consulting with an intellectual property lawyer to develop a comprehensive IP strategy tailored to your business. They can guide you through the registration process, conduct IP audits, and provide advice on enforcing and defending your intellectual property rights in the UK.

Marketing and Promoting Your UK Business

Effective marketing is crucial for attracting customers, building brand awareness, and driving the success of your UK business. Here are some key considerations for creating a robust marketing strategy:

Target Audience Research:

Identify your target audience and conduct thorough research to understand their needs, preferences, and buying habits. This will help you tailor your marketing messages and choose the most effective marketing channels.

Branding:

Create a strong brand identity that reflects your business values and resonates with your target audience. Develop a compelling brand story, design a memorable logo, and establish consistent branding across all marketing materials.

Website and Online Presence:

Build a professional website that showcases your products or services. Optimize it for search engines (SEO) to improve visibility in search results. Consider creating engaging content, starting a blog, and utilizing social media platforms to expand your online presence.

Digital Marketing:

Explore various digital marketing channels such as search engine marketing (SEM), social media advertising, email marketing, and content marketing. Develop a strategy that aligns with your target audience and business objectives.

Traditional Advertising:

Traditional advertising methods like print ads, radio, or outdoor billboards can still be effective, depending on your target market. Evaluate the cost-effectiveness and reach of different traditional advertising options to determine the best fit for your business.

Social Media Engagement:

Engage with your audience on social media platforms relevant to your business. Regularly post valuable content, respond to comments and messages, and build relationships with influencers or industry leaders to expand your reach.

Customer Relationship Management (CRM):

Implement a CRM system to manage customer relationships effectively. Collect customer data, track interactions, and personalize your marketing efforts to enhance customer loyalty and drive repeat business.

Analytics and Measurement:

Track and analyze your marketing efforts using analytics tools. Monitor key metrics such as website traffic, conversion rates, and customer engagement. Use this data to refine your marketing strategy and optimize your campaigns.

Remember, effective marketing requires continuous learning and adaptation. Stay up to date with industry trends and leverage both online and offline marketing techniques to reach your target audience and achieve your business goals in the UK.

Support and Resources for UK Businesses

Starting and growing a business in the UK can be a daunting task, but fortunately, there are numerous support networks and resources available to help you along the way. Here are some valuable sources of support for UK businesses:

Government Initiatives:

The UK government offers a range of initiatives and programs to support businesses. Explore resources such as the Business Support Helpline, local enterprise partnerships (LEPs), and government-backed loan schemes like the Start Up Loans Program or the Enterprise Finance Guarantee.

Business Networks and Associations:

Joining business networks and associations can provide valuable opportunities for networking, collaboration, and knowledge-sharing. Look for organizations and groups relevant to your industry or location that can offer support, mentorship, and access to potential customers or investors.

Mentoring and Coaching:

Engage with experienced business mentors or coaches who can provide guidance, advice, and insights based on their own entrepreneurial journeys. Organizations like Mentorsme or the Prince’s Trust offer mentorship programs specifically designed for entrepreneurs.

Incubators and Accelerators:

Consider joining an incubator or accelerator program that provides resources, mentorship, and access to funding opportunities. These programs often offer workspace, networking events, and tailored support to help you grow your business at an accelerated pace.

Trade Associations and Chambers of Commerce:

Industry-specific trade associations and chambers of commerce can provide sector-specific support, lobbying, and networking opportunities. They often organize events, conferences, and training programs that can help you stay up to date with industry trends and connect with like-minded professionals.

Business Grants and Competitions:

Keep an eye out for business grants and competitions that offer funding or other forms of support. Organizations like Innovate UK or local business growth hubs often run competitions or grant programs to encourage innovation and entrepreneurship.

Online Resources and Communities:

Take advantage of online resources such as business forums, online communities, and educational platforms that offer valuable insights, advice, and access to a supportive network of entrepreneurs.

Remember to tap into these resources, ask for help when needed, and leverage the knowledge and experiences of others. Building a strong support network and utilizing available resources can significantly increase your chances of success as you navigate the UK business landscape.

In conclusion, setting up a business in the UK requires careful planning, knowledge of legal requirements, and a solid understanding of the market landscape. By following the steps outlined in this guide, you can navigate the process with confidence and increase your chances of success.

Remember to conduct thorough research, seek professional advice when needed, and take advantage of the resources and support available to UK businesses. Whether it’s government initiatives, business networks, or mentorship programs, these resources can provide valuable guidance, funding opportunities, and a supportive community.

Additionally, ensure compliance with tax obligations, protect your intellectual property, and create a comprehensive marketing strategy to promote your business effectively. By considering these factors and making informed decisions, you can establish a strong foundation for your UK business.

Setting up a business is an exciting journey filled with challenges and rewards. Stay resilient, adaptable, and committed to continuous learning. With determination and the right support, your UK business can thrive and contribute to the vibrant and dynamic business landscape in the country.